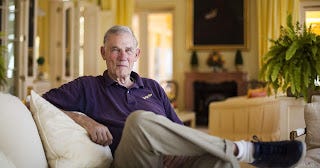

Bob Monks: In memoriam of a great ESG mentor.

The death of Bob Monks on April 29 is one of those moments that makes you reflect on time passing, what you’re doing and why.

That reflection feels somehow appropriate as we respond to a massive US pushback on green transition and a rollback of sustainability regulation in Europe in a world of depressing conflict, mis- and dis-information and a dearth of progress towards environmentally and socially ‘better’ in an ever-more-fraught political and economic arena.

Bob was a touchstone for more people in the responsible investing world than I realised (a mark of the great networker). The irony of an ‘in memoriam’ for someone so influential is that it’s one of those times when you realise just how many people enjoyed pivotal contact with them, and how alive that connection still is.

A quick look at Nell Minow’s Linked-In tribute to Bob:

Or that of Paul Lee, says it all:

And then you recall the stories: Bob recounting his student interview with Charles de Gaulle - one of perhaps a few guys actually taller than him - at De Gaulle’s home in Colombey-les-Deux-Églises!

Or rowing with the winning Cambridge team in the Oxford-Cambridge boat race back in 1955.

Or explaining how a Republican lawyer (as Bob was) became a game changer in corporate governance and environmentalism.

It is incredible to think that Bob founded Institutional Shareholder Services (ISS) in 1985; that’s almost pre-history in the world of organised, sustainable finance. https://insights.issgovernance.com/posts/statement-in-connection-with-the-passing-of-robert-a-g-monks/

If we think times are hard now, imagine what it was like talking up proxy voting for corporate restraint back in the go-go, yuppie 80s.

Don’t think responsible investing can work? Think again. ISS was bought in 2020 by Deutsche Borse for 1.5bn euros. Go woke, go broke? Nope. (I promise I will never use that pejorative epithet again!)

Bob was a serial entrepreneur, founding Lens Investment Management, Lens Governance Advisors, The Corporate Library (now part of MSCI), and having a hand on the tiller of business development of Trucost, now owned by S&P.

All the while he kept reaching out to people internationally encouraging them in the work of sustainable finance.

I first met Bob after I’d pitched him to be the first video interviewee for the launch of Responsible Investor back in 2006.

I’d spoken to him a little in the years before then through reporting around AGM battles when I was Editor at IPE.com

and then Asset Management Editor at Financial News in the late 90s, early 2000s.

He was regularly in London in those days with Hermes Lens Asset Management in an office on Threadneedle Street, near to the Bank of England.

I’d been marked by his thinking on corporate governance; active shareholder ownership for longer-term, sustainable economic outcomes.

Bob was a big cheese. I didn’t think he’d agree to be interviewed for our little, start-up ESG e-zine. He did, and was incredibly gracious with his time and encouragement.

It was an affirmation for us that this ‘oxymoronic’ investment publication had meaning beyond our desire to get it off the ground.

I ran into Bob regularly over the years grabbing breakfast or lunch at events where possible and exchanging views and thoughts; often he was in town with his lovely wife Millie.

Reading the recollections of Bob by respected peers, you realise how far the mentorship seeds he sowed in corporate governance and responsible investment spread, grew and matured.

Bob was a hard-headed realist as well as an activist. He never expected irresponsible corporations to cave in under shareholder pressure, nor sustainable investor oversight of markets to be easy; anything but…

Those lessons to me feel more relevant than ever when I think about Bob and the current predicament of sustainable finance.

You have to create your own solutions, agitate, make them a financial and social reality, and even then…

I aspire to be a bit more like Bob Monks.

As I’m sure all do who he ‘spoke to’ through his work, his books, his conference addresses, or having had the honour to have known him.

Lovely tribute, Hugh.

Thanks Hugh for sharing your stories about Bob as well as the links for further exploration. Bob was instrumental in getting me to leave the mainstream business world and take on my first role in sustainable investing in 2002. He was an invaluable mentor in many a challenging period and his wise words remain helpful in today’s turbulent times.