Who’s afraid of the dangerous Climate Action 100+ gang?

A recent US House Committee report accused CA100+ of being a climate cartel and a cabal that wants to drive us back to the dark ages…so where's the fightback?

I recently finished watching Boardwalk Empire, the US drama series on the violent, criminal lives of Al Capone, Lucky Luciano and Enoch Johnson, controller of Atlantic City (under the guise of Nucky Thompson in the series, a psychologically fraught liquor bootlegger).

I needn't have bothered with a TV drama crime fix, however.

I could just have read the shakedown tale of that feared outfit, the Climate Action 100+ (CA100+) gang.

Now, you may have thought that CA100+ was a group of 600+ of the world’s biggest long-term investors asking questions to company boards based on the best-available science regarding accountability and oversight on climate change risk.

You might have also understood that they were asking those same companies to reduce emissions over time in line with the Paris Agreement, to which many governments are signatories, (and potentially some US states, even now).

You may also have been under the illusion that these same investors would be ‘talking’ to policymakers about the barriers to sector transition in a bid to make progress on resolving them.

And lastly, you may have been fooled into believing the investors were seeking to better understand company business plans in light of the transition that many governments have signed up to.

But no!

The CA100+ gang has been forcing, nay ‘threatening’ - perhaps by stapling fingers to proxy voting buttons - some of the world’s biggest fund managers to join it, according to startling evidence compiled by the House of Representatives Committee on the Judiciary , which has taken time out from important work on issues like Presidential impeachment, to track down the CA100+ gang.

Logo of The House of Representative Committee on the Judiciary

There’s more. The CA100+ crew has formed a ‘climate cartel’ to shakedown some of the world’s biggest companies.

In case you didn’t read that right, the 78 page report repeats the words ‘climate cartel’ around 300 times!

Or, if you like it darker: “The climate cartel is a cabal of financial institutions”, meaning a secret political clique or faction…fiendish enough, it seems, to create a website and press release all the joiners in order to throw investigators off the scent.

One of the poor, defenceless companies that was the victim of these menaces is the friendly, neighbourhood oil giant, Exxon Mobil, which was muscled (via the ole proxy voting threat) into accepting director infiltrators onto its board through the Engine No 1 resolution.

Or, as the report nails it in bold: THE CLIMATE CARTEL COLLUDED TO TAKE OVER AMERICA’S LARGEST ENERGY PRODUCER

Yikes! What boloney…

Now, my understanding of the term cartel was a group of companies restricting output or controlling prices to boost their own coffers.

So, I’m happy to find out that a ‘climate cartel’ is actually one that deprives Americans of gas (or petrol to us Brits) in order to make those same investors lose money; crazy, socialist capitalists!

And just in case you wondered who the technological patriot of this corporate mugging is, the report notes that: “the Wright brothers used its fuel (that of Exxon Mobil) to take flight from Kitty Hawk, North Carolina; and Charles Lindbergh relied on its oil on his historic flight across the Atlantic.”

In addition, Exxon “company has 11,000 fuel stations ‘sprinkled’ throughout the United States”, which must be one of the most poetic descriptions of gas stations I’ve seen!

It is of a piece with a report that is heavy on slanted, often outrageous, allegations. Trumpian, for want of a better word.

I seriously doubt that the CA100+ group will fall foul of US ‘acting in concert’ rules, given the care the organisation took to ensure investors engaged and voted their own stock.

The House Committee holds up a big constitutional stick though: “If there are to be “departures from the notion of a free-enterprise system as it was originally conceived in this country,” it must be “the product of congressional action and the will of the people” rather than that of “private forces.”

To be fair to the Committee (and to be honest, I really don’t want to be after reading such a shoddy report), there are, of course, some fundamental points here. Collective investor engagement was always going to face the issue that it is seeking to prod companies to diversify or get out of their core business - hard enough (maybe even impossible or undesirable) in itself. It can also face the allegation of being undemocratic if governments are not fully behind the work.

The Committee threatens legal action, suggesting that US securities law requires companies to disclose “material” information, not what it calls “speculative estimates of “the impacts on [its] oil and gas reserves and resources” under a theoretical, net-zero scenario “in which reduction in demand results from carbon restrictions . . . adopted by governments.”

In its defence, CA100+ said: “The U.S. House Judiciary Committee has grossly misrepresented investor participation in Climate Action 100+. Specifically, they have misrepresented the nature of investor stewardship of the financial risks of climate change, investor-led engagements with companies, and U.S. antitrust laws. Investors are pursuing a responsible, common-sense approach to deliver the best long-term returns for their clients and beneficiaries. Neither they nor the initiative are violating antitrust laws. Investors are acting entirely independently in their own investment and voting decisions.”

CA100+ cites several legal experts in its ‘anti-trust’ defence:

Wilson Sonsini: https://www.wsgr.com/en/insights/antitrust-laws-and-esg-shareholder-engagement-2025.html

Sabin Center for Climate Change Law: https://climate.law.columbia.edu/news/ccsi-and-sabin-center-release-new-report-antitrust-and-sustainability-landscape-analysis

SSRN/Academic Paper: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5078213

It also cites a rival report from the same Committee, the U.S. House Judiciary Committee minority report released in June 2024 by Jerrold Nadler, Ranking Member of the House Judiciary Committee, which pushes back against the Committee's antitrust claims.

Phew…

Furthermore, Ceres says that in the last few years hundreds of state legislative bills in the U.S. seeking to ban responsible investing practices have been defeated in part due to the economic costs of implementation.

The battle, of course, is the pain point: such a monumental, partisan legal tussle on climate change action by investors sucks up vast time and resources. It’s a known stalling tactic.

It also presents investors with the serious headache of having documentation subpoenaed (dozens of investors have been), which has no doubt led to decisions to leave the initiative.

Ceres, the sustainability non-profit, and lead secretariat for CA100+, had a huge sump of e-mail communications on the initiative subpoenaed and used against it by the House Committee for its report: See the Exhibits at the foot of this link.

So I can understand why asset managers including Northern Trust, Blackrock’s US operations, State Street, Franklin Templeton, JP Morgan, MFS and Muzinich have left.

That said, the same managers need to be held to account on what their ‘actual’ response to the climate risk issue is, otherwise they shouldn’t have joined in the first place and potentially misled a good portion of their clients about their intentions.

Companies should not be able to burnish climate credentials when it suits them and drop them when it doesn’t.

At its peak in 2023, CA100+ had 700 investor signatories with assets of $68 trillion. Ceres says the initiative has some 600+ investors now.

It’s not one-way traffic. Ceres says that since July 2023 there have been 95 new joiners, 56 voluntary departures and 37 leavers due to mergers and delisting.

None of this drama, however, should prevent us from asking the bigger question as to whether CA100+ has been successful or not (and not just in riling Republicans, although the pushback undoubtedly shows that things are getting serious.)?

There has long been scepticism about whether collaborative engagements such as CA100+ can achieve their aims.

Well known critiques include:

Flawed incentives: Asset owners and asset managers are not necessarily (and maybe not often) aligned because of the business interest of the latter in fund flows and fees.

Engagement inefficacy: Research shows engagement works primarily for ‘material’ financial issues, for which climate change is ‘complex’ to say the least: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4171496

Also, companies will not take action to reduce profitability.

Wrong focus: supply vs demand for oil/gas, for example.

Geographical issues: US companies are held mostly by US investors, who are, in turn, divided on climate change.

Politics: Neither the US government, nor many states, are going to support climate in a meaningful way in the coming four years of the Trump administration.

There is an argument that CA100+ should have seen these problems coming!

I have sympathy for this point, but I’m a bit less sceptical.

However, I am concerned about who is actually publicly defending CA100+ at the moment?

None of the founder groups appear to be saying much (Ceres, PRI, the global investor groups on climate change: IGCC, AIGCC, IIGCC). Have a look on their websites to see if they have responded. Where are the newspaper op-eds?

This is not good enough. Keeping your head down and answering journalist’s questions is not a strategy in the current environment, nor a good look.

Indeed, part of the problem may be that CA100+ is facing a bigger issue: whether it works or not?

Nicholas Hastreister, Policy Fellow at the Grantham Institute on Climate Change and the Environment, has carried out an interesting empirical research study on the outcomes of Climate Action 100+ engagements: https://www.lse.ac.uk/granthaminstitute/publication/can-investor-coalitions-drive-corporate-climate-action/

The study finds no empirical support for a statistically significant impact on company climate-related disclosure as a result of CA100+.

In addition, it finds no impact on carbon intensity.

It does though find some effect on medium and long-term target setting for CO2 reductions, with the caveat that companies are setting long-term targets without any short- to medium-term milestones, which, it says, may constitute a form of greenwashing.

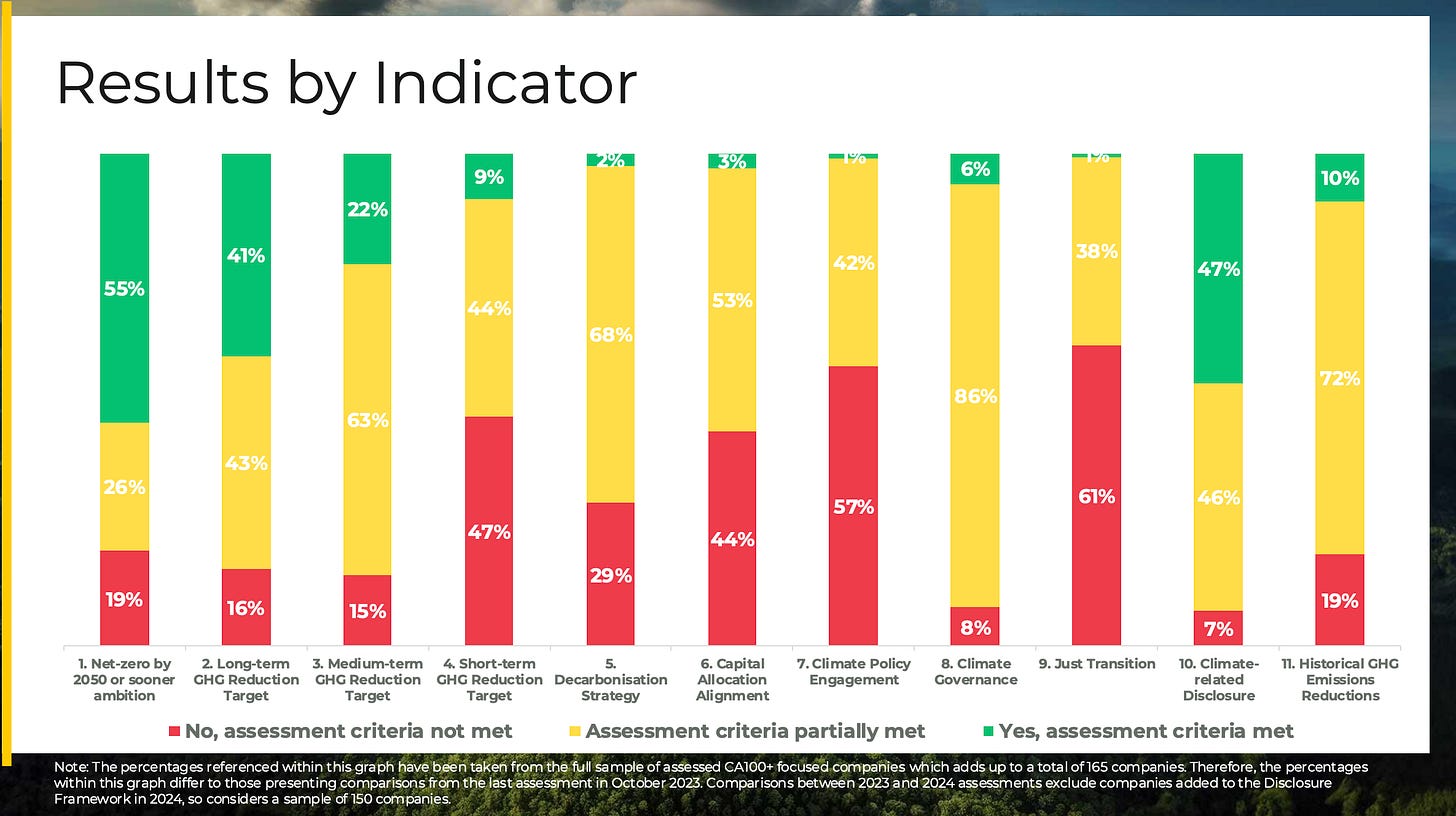

CA100+ says the emissions performance of CA100+ focus companies (its biggest engagement targets) shows that 65% have reduced their emissions intensity in the past year.

CA100+ sample results of 165 focus companies

It pointed me towards its latest benchmark report here and engagement case studies here which it says shows qualitative examples of CA100+ engagement impact.

So, what does this all mean for CA100+?

Well, I think it needs to ask itself serious questions about whether such a political showdown could have been avoided, and whether its strategy is the right one in terms of cost and efficacy.

Earlier this month, The Net Zero Asset Management Initiative said it was pausing its activities to examine strategy in the light of regulatory developments in the US and elsewhere:

https://www.netzeroassetmanagers.org/update-from-the-net-zero-asset-managers-initiative/

CA100+ should not be scared of doing the same.

There are no easy answers to strategic review.

But, a renewed focus on clearly aligning with policymakers on smart, long-term regulatory incentives for climate transition that would demonstrate lower cost, competitive energy could be a start.

Simultaneously, a coalition strategy with companies to work on the cost side of the balance sheet for sectoral, low carbon transition could be another.

Mutual capital allocation to large-scale public-private partnerships via blended finance can also fund the required technological advances.

Investor coalitions are the right approach, but they have to demonstrate they can work, and fast.

Excellent work on this one Hugh. Thanks for digesting the committee report and thinking through the implications. The backlash for CA 100+ should not be viewed as a surprise. The work by a very seasoned group of lobbyists (Exxon + the fracking crowd) and think tanks started in 2019. Some of their interests are now diverging, but AMs and AOs will be a defensive crouch regardless. We all know the games that can be played with financial materiality, but that's where the work must be done.

Nice summary Hugh. A couple of things clearly stand out:

1. US securities law requires companies to disclose “material” information, not what it calls “speculative estimates of “the impacts on [its] oil and gas reserves and resources” under a theoretical, net-zero scenario “in which reduction in demand results from carbon restrictions . . . adopted by governments.

2. “If there are to be “departures from the notion of a free-enterprise system as it was originally conceived in this country,” it must be “the product of congressional action and the will of the people” rather than that of “private forces.”

Facit: only Congress can drive carbon restrictions, not private forces, aka markets. And Congress acts on behalf of the "people" not shareholders. This undermines the core stipulation of sustainable investment and "engagement", which is that markets can guide corporate behavior from dirty to clean. In the view of the Committee, investors can only respond to failures of risk management. The assumption being that climate risks are not cumulative and crippling and can readily be overcome with fiscal or monetary policy.

So, if shareholders need to pay attention to "material issues" and not "speculative" fuel switching scenarios means we are in a "risk-on" world now, where climate mitigation is stalled and our society, including lots of corporate assets, infrastructure and built environment writ large is increasingly exposed to extreme weather.

Climate100+ engagement needs to rapidly switch to guiding investment in solutions (EVs and demand for fossil fuel), risk modelers and "clean-up" and rebuilding companies to remain relevant. Cliamte100+ strategy of targeting energy supply without also targeting demand was always going to be a failure.