Exclusive: Five senior staff leave in just one month amidst broader exodus at Arabesque, the ESG research/investment firm, as losses deepen.

Flurry of senior exits mirrors those of former subsidiary ESG Book, in which Arabesque retains a stake.

Exclusive

Arabesque AI, the research company that is part-owned by DWS, the German asset manager that agreed to pay $25m in fines to the SEC last year for misleading statements on ESG integration, has lost its Chief Executive Officer (CEO), while its umbrella company, Arabesque, lost its Chief Product Officer (CPO), its Head of Client Solutions, its Human Resources (HR) Director and its Business Development Director, all in the same month.

The wave of senior departures during a chaotic month of May - none of which were announced by the company - comes on the back of deepening losses at the Arabesque Partnership, the holding company for the Arabesque subsidiaries.

Its latest filed accounts, which were published last week, show pre-tax losses for 2022 of £20.6m, after pre-tax losses in 2021 of £14m.

Carolina Minio Paluello, who joined Arabesque AI as CEO in October 2022, left in May after 1 yr and 8 months in post. She previously worked at Schroders as Global Head of Product, Marketing, Solutions and Quant after several years at Lombard Odier as a Global Head of Sales and Solutions and Deputy CIO.

Caroline Minio Paluello

Also in May, Arabesque, the umbrella company that includes Arabesque AI and Arabesque Asset Management, lost Tim Wong, its CPO, after a year and 9 months in the job. Wong joined in September 2022 from Finbourne Technology, after stints at companies including Amazon, Capco, McKinsey and PwC.

In the same month, Gabriel Karageorgiou, Head of Client Solutions at Arabesque, left after just under 10 years at the company. Karageorgiou had previously been a Partner and co-Founder at KKS Advisors, and before that an Assistant Vice President at Barclays Capital.

Claire Henshaw-Green, Human Resources Director/Head of People was another May leaver following her resignation after just 1 yr and 3 months in post. She had previously spent just over 6 years at Railsbank as Head of Engagement, Performance and Talent Management.

Simultaneously, Nicholas Stott, Arabesque’s Business Development Director, left after six years at the firm and has recently joined Bridgewater Associates in Singapore.

In addition, Nikolaos Kaplis, Arabesque’s Chief Technology Officer (CTO), left in January this year after 5 years and 5 months at the company, which included a period as Head of Artificial Intelligence Research at S-Ray, now called ESG Book.

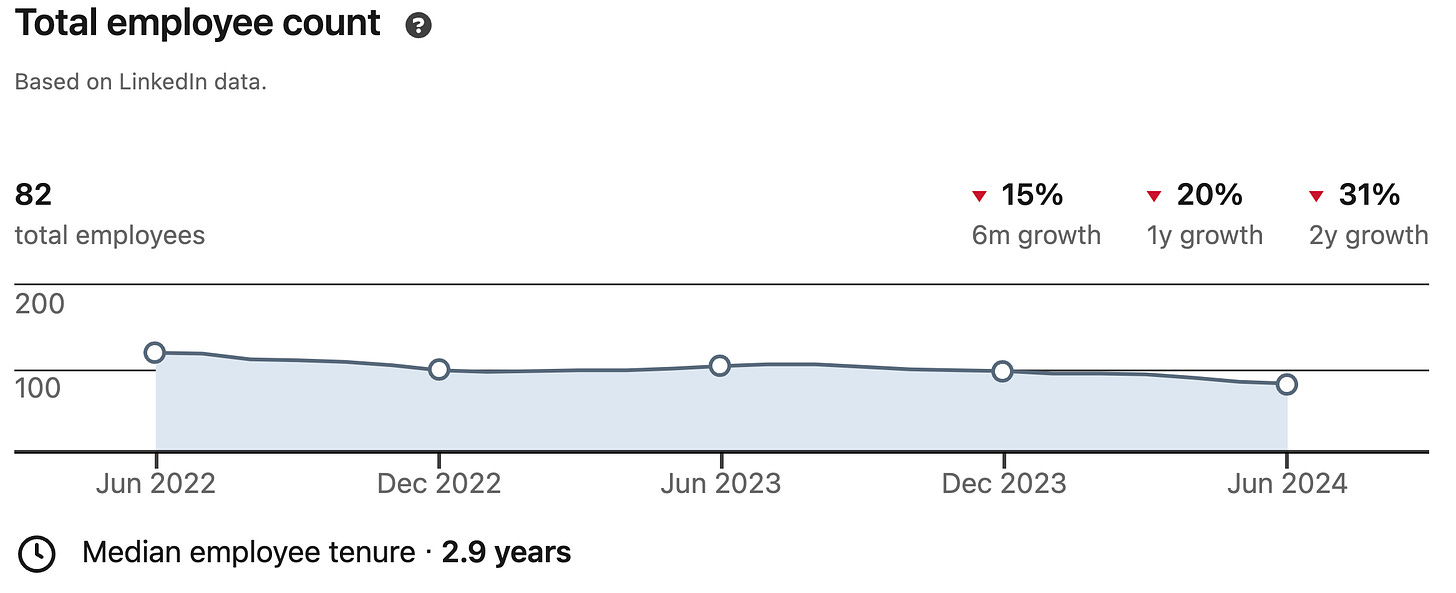

More broadly, Arabesque has lost roughly 30% of its staff in the last two years according to Linked-In data.

Arabesque employee count

In June 2022, it had 119 staff working for it. By June 2024, the number had dropped to 85, down 29% in 2 years, although that is likely to be an overestimation as staff tend to maintain their former employers name on Linked-In until they find another position elsewhere.

Arabesque could not be reached for comment on the departures.

The departures from the Arabesque group mirror a slew of recent senior departures from ESG Book, the Frankfurt-based research firm, which was previously known as Arabesque S-Ray, and in which the Arabesque Partnership, still holds an investment stake via a subsidiary called Arabesque Investment Ltd.

Link to my last piece: Why are ESG research houses losing senior staff?

As well as the stake in ESG Book, Arabesque has three main business lines:

Arabesque Asset Management, which has offices in London, Frankfurt, Singapore and New York.

S-World, a digital assets business.

Arabesque AI, which sells a technology-based service that tailors asset portfolios to investment and sustainability preferences.

Arabesque AI has been losing money. In 2022 it lost £2.7m, adding to £2m of losses in 2021. Assets under advisory for its products fell back in 2022 to £460.1m from £506.7m a year earlier.

DWS, the German funds giant, which bought 24.9% of Arabesque AI in January 2020 has already marked down the investment.

In its 2022 annual report, DWS said that impairment on financial assets and securities amounted to € 71 million compared to € 17 million the previous year and included its investment in Arabesque AI.

In 2023, DWS agreed to pay $25m in penalties in two separate enforcement actions, one of which concerned misstatements regarding its ESG investment process.

By the end of 2022, Arabesque owed its founder, Omar Selim, £15.4m under a loan arrangement from Selim to the company, up from £13.7m in 2021.

Omar Selim

The Designated Members of the Arabesque Partnership - akin to Directors at a public company - are Omar Selim and Dominic Selwood, a well-known English historian, journalist, author and barrister. Both Selim and Selwood were former investment bankers at Barclays. Selim was previously head of global markets for institutional clients in Europe, the Middle East, Africa and Eastern Europe. Selwood was Global Head of Islamic Products.

In June 2023, a number of Arabesque board members left, including Barbara Krumsiek, former President and CEO of Calvert Investments, and Carolyn Woo, former CEO of Catholic Relief Services. Yolanda Kakabadse, former President of WWF International, left the board in December 2022.

Georg Kell, founding Executive Director of the UN Global Compact, remains on the Arabesque board.

Wow ....that is a lot of leavers ...